|

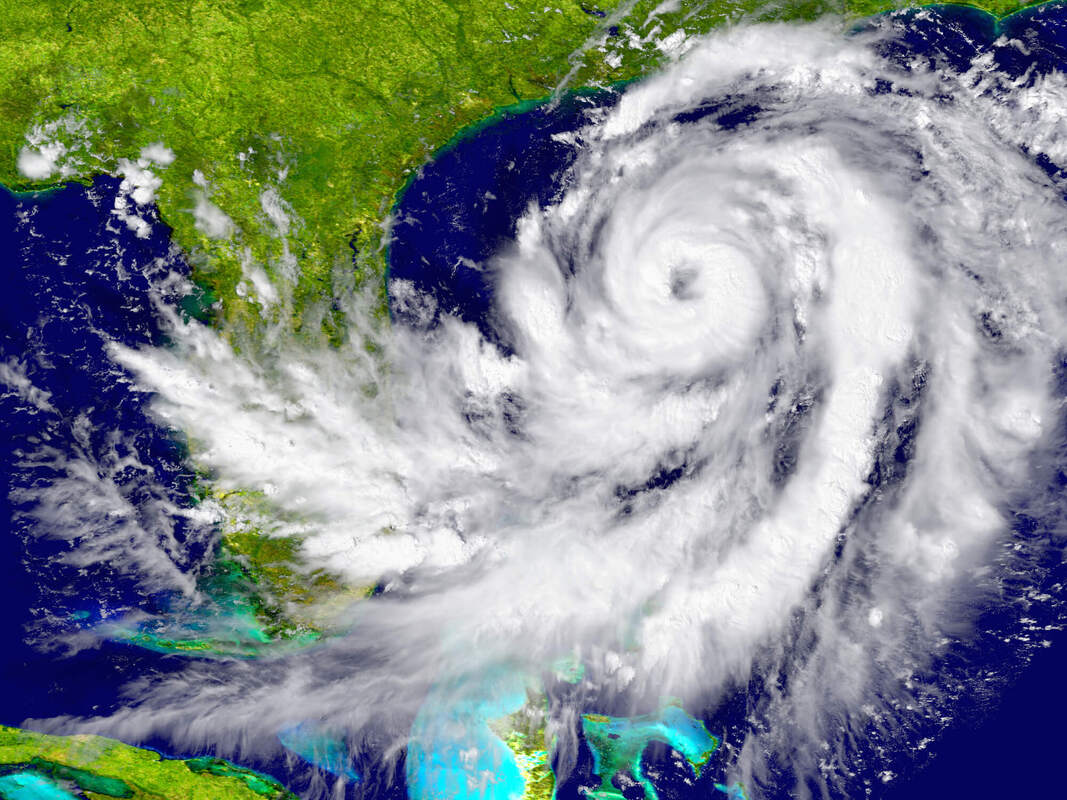

As public adjusters in Broward County, we have had significant experience through the years helping property owners get compensation and full coverage after a hurricane. The process is more confusing than what most expect when they file a property damage insurance claim.

Let’s discuss the policies that provide coverage, as well as explain the best action to take to get compensation from your insurance company. Which Policies Provide Coverage in the Event of Hurricane Damage Insurers do not typically offer a specific hurricane insurance policy. This means that the damage incurred during a storm must be covered under your wind or hurricane coverage within your policy. While insurance policies often vary, yours will likely provide this coverage, but it comes with a price of a higher deductible. Windstorm Insurance While this is sometimes referred to as a wind or hurricane policy, it does not always cover water damage caused by flooding. The key is whether the water damage is caused by the wind. For instance, if wind damage provides an opening in your property that then water enters your property and causes water damage, you will be covered. You are less likely to get compensation if the water damage is unrelated to wind or flooding unless you have a separate flood insurance policy. Flood Insurance Flood insurance is designed to cover the water damage caused by things like storm surges or flooding. The flood needs to cover more than just your property or spread across at least two acres. Can You Get Compensation for Mold or Debris Removal? Homeowners insurance can provide coverage for mold. However, insurers do not provide coverage or compensation if the mold is a result of negligence or lack of maintenance to your property. Homeowners insurance can also provide coverage and compensation for debris removal, but that amount is usually capped within the policy. That said, this coverage can be limited, and you may still need to incur a portion of the debris removal. How You Can Get Compensation With Your Current Coverage Being properly covered before a loss is important. If a hurricane has already come, it is too late to change your policy if you sustain damage. It is a good idea to speak to a public adjuster with the knowledge and experience to review your policy in detail and determine if you have property coverage. If your property damage claim is underpaid or wrongfully denied, a public adjuster can assist you at any time. Our experience and expertise allow us to understand everything you are entitled to in order to get the compensation you deserve. Looking for a Public Adjuster in Broward County? At Reliant Insurance Adjusters, we are committed to helping property owners file proper claims with their insurance company. Whether you are ready to file a claim or you are anticipating a potential loss, we are here to help. We offer Pre-Loss Property Inspections, which prove your property was not damaged prior to a loss. Please do not hesitate to contact us through our site or call us (561) 288-6434 today.

0 Comments

Insurance claim disputes are common, as questions surrounding property damage, property repairs, total cost of repairs, and whether all or part of your claim is covered may be the subject of disagreement between you and your insurer.

When it comes to the technical and legal dynamics involved in claims disputes, you are often on an uneven playing field with your insurance company. The best path to resolve a claim dispute depends on your individual situation, and the different avenues of resolution have varying pros and cons. This is when having a qualified, professional public insurance adjuster in your corner is essential. Explaining Arbitration, Mediation & Appraisal Here are the three different options your policy may provide when you have an insurance claim dispute: Arbitration, Mediation, and Appraisal. Arbitration A need for arbitration has started appearing more regularly in some property insurance contracts. But what precisely is arbitration and how is it different from litigation or a trial? Alternative Dispute Resolution (ADR) is the name given to arbitration. This is where all parties consent to abide by and respect the arbitrator's ruling. A person or authority appointed as the arbitrator, who in actuality has the same authority as a judge but is only responsible for the specific dispute at hand, is in control of this process. The goal of arbitration is for the arbitrator to resolve disputes in the most just manner possible after hearing from all sides and analyzing their respective arguments. Arbitration is not necessarily intended to reach a compromise between the parties, but it can be a faster and more cost-effective way of settling a dispute, as it allows you to avoid a trial. Mediation The most common method of resolving claim disputes is mediation, whether it is voluntary or ordered by the court. Mediation is a way to resolve a claims dispute between the policyholder and the insurance company where a neutral third-party mediator acts to encourage and assist in the resolution of a dispute. The insured and insurer participate in the decision-making process during mediation, but not during arbitration, where they can simply state their claims. A mediator lacks the authority to make a ruling and assign damages, unlike an arbitrator. Although the nature of mediation is much more informal and the mediator typically encourages the parties to reach a solution on their own, he/she does not pass any orders. When a compromise is reached, the parties draft a settlement agreement. The only grounds for challenging the final settlement in court are fraud and deception. One advantage of mediation is that it may be quicker and less expensive than going to trial. A negative element of mediation may be that cases sometimes settle in mediation for less than their true value or do not settle at all. Appraisal The appraisal process, which is a stipulation outlined in most commercial and residential insurance policies, can be used as an alternative dispute resolution mechanism to avoid litigation or to resolve portions of an insurance claim. Since both appraisal and arbitration are alternative conflict resolution procedures that enable issues to be addressed without the need for litigation, they do share some similarities. The provision for appraisals can typically be found under the Loss Settlement section of your policy. When the insurance company and policyholder cannot agree on the amount of loss, it is an Alternative Dispute Resolution that can settle disputes in rather than filing a lawsuit. The majority of property insurance policies have language that allows "appraisals" to be used to settle disagreements on the scope and value of a loss. A real estate or art appraisal is not the same as an insurance appraisal. The extent and severity of a loss (what was damaged and how badly), as well as the cost of the loss (how much repairs should cost), can be determined by an insurance appraisal. Most appraisal clauses within an insurance policy provides that any party may request an appraisal in writing if the insurer and insured cannot agree on the amount of the loss. Each party is responsible for hiring their own appraiser. Then the two appraisers will select an impartial individual who will act as an umpire if they cannot agree on the settlement of the loss. In that event, the umpire will be called in to assess the loss and settle the claim. Looking For a Licensed Public Insurance Adjuster or Appraiser to Guide You Through the Claims Process? A Public Adjuster or Appraiser acts as your advocate and will make sure you receive a proper settlement of your claim. At Reliant Insurance Adjusters, we are dedicated to our clients, and are here to alleviate any stress from your claim. We have the expertise and experience needed to navigate this complicated process. Contact us today (561) 288-6434 for any questions or assistance with your insurance claim. The existence of apps like Airbnb has led many people to start renting their homes out on a short-term basis. While this can represent a new income stream for homeowners, it can also lead to insurance complications if you do not have the correct insurance policy on your property.

Does homeowners insurance provide coverage if you are renting your home for a short period of time? If not, what are your best options for getting the compensation you need if a guest causes damage to your property? Learn what you need to know from expert Palm Beach County public adjusters. What Kinds of Damage Do You Need Coverage For? There are two major things you need to be prepared for when renting out your home:

Does Your Homeowners Insurance Policy Cover Damage Caused During Short-Term Rentals? A standard homeowner insurance policy will not cover damage caused if you are regularly renting your property. For this, you would need a dwelling policy. It is important to review your policy, because you may be required to inform the insurance company before renting or even add an endorsement to obtain coverage. If you sustain damage to your property and believe your policy covers the damage caused during a rental period, you should consult with a public adjuster. They will have the knowledge and expertise necessary to review your policy and assist you with filing an insurance claim. Getting Covered for Damage Caused During a Short-Term Rental If damage occurs to your property while you are renting it, there are several options available to you. First, you need to determine if the damage is covered by your policy (e.g., a natural disaster, fire damage or water damage that occurs while you were renting your property). If your insurance policy does not cover the damage, you might still be able to receive compensation elsewhere. For instance, Airbnb offers host damage protection for up to $1 million. It is important to note that AirCover for Hosts will not provide coverage for damage that is covered under a typical homeowners insurance policy like hurricane damage. In order to receive coverage by Airbnb, you are required to provide evidence of the damage. If you plan on renting your home, it is important to perform an inspection ahead of time. This way, you will document the condition of your property prior to anyone staying in your home and proof that any damage that occurs happened during the rental. Looking for Palm Beach County Public Adjusters You have come to the right place. At Reliant Insurance Adjusters, we work with residential and commercial property owners to help ensure you receive everything you are entitled to for your insurance claim. We have decades of experience in the insurance industry, and our reputation speaks volumes. Now, more than ever, insurance policies cover less and less. We are always happy to help you gain a better understanding of what your policy does and does not cover. Please do not hesitate to contact us or call (561) 288-6434. Whether you own a residential or commercial property, it is crucial that you properly insure this significant investment to protect yourself and your belongings, and It is just as important to be fully aware of what your coverage entails.

When purchasing property insurance, the first step is to read the policy in its entirety, especially when it comes to the topic of water damage. Insurance claims for water damage can take many different forms, and if your specific issue is not covered, you will be responsible for all costs associated with repair and replacement of your damaged items. Determining the root cause of water damage, reviewing whether your policy covers the damage, as well as understanding any limits that may exist on that coverage can be a challenge. Here, we break it down for you so you can understand your policy. Types of Water Damage Covered Under Most Policies Water damage is often not covered by insurance policies, or the coverage you do have may not fully address the damage you may encounter. For instance, internal water damage caused by broken pipes or water heaters, such as damaged walls or flooring, is frequently covered. However, your property might not be covered by your insurance policy if the water damage was caused by inadequate upkeep or a flood. The two common types of insurance coverage are dwelling coverage and personal property coverage. While personal property coverage will cover you for damaged to your belongings like furniture etc., dwelling coverage assists in covering the damage to the interior of your property like walls and flooring. Is Water Damage Coverage Limited By Insurance? When a catastrophe happens, many people believe that the full cost of water damage will be covered by their insurance. All too often, once the insurance company’s field adjuster visits your property to evaluate the damage, the insurance company informs you that your policy has a limit. For example, you may be told your policy is limited to $10,000 but the overall damages will cost several thousands of dollars or higher. In fact, some insurers are now starting to completely eliminate water damage coverage for buildings older than 40 years. However, you may be given the choice to pay an extra premium to have limited water damage coverage included in your policy. Some insurance companies have also refused to provide water damage coverage if the plumbing is older or original to the property. In those cases, they have requested the plumbing be changed and upgraded in order to provide water damage coverage. So, if you have cast iron plumbing, they may request you change the plumbing system to PVC pipes. Erosion of Coverage When you buy residential or commercial property insurance coverage, you expect to be covered when and if you need to file an insurance claim. However, is possible that when you do need to file a claim, you are then shocked to find out that you are not fully covered. We refer to this as the insurance industry's constant erosion of coverage. Insurance companies are either placing limits on coverage or excluding coverage all together. For example, there are some policies with coverage limitations for leaks of any kind that go on for a period of 14 days or more, whether hidden or not. Some insurance companies have added language to their policies that says that the damage caused in the days preceding the 14 days will not be covered if this limit applies. We Are Here to Help You Understanding what you are and are not covered for is crucial. At Reliant Insurance Adjusters, we provide free insurance policy reviews and coverage recommendations to help ensure you have the necessary property coverage. If you need assistance filing a water damage claim or any other property damage claim, we are ready to help! Call us today at to (561) 288-6434 or contact us here get started. |

AuthorKaren Schiffmiller Archives

July 2024

Categories |