|

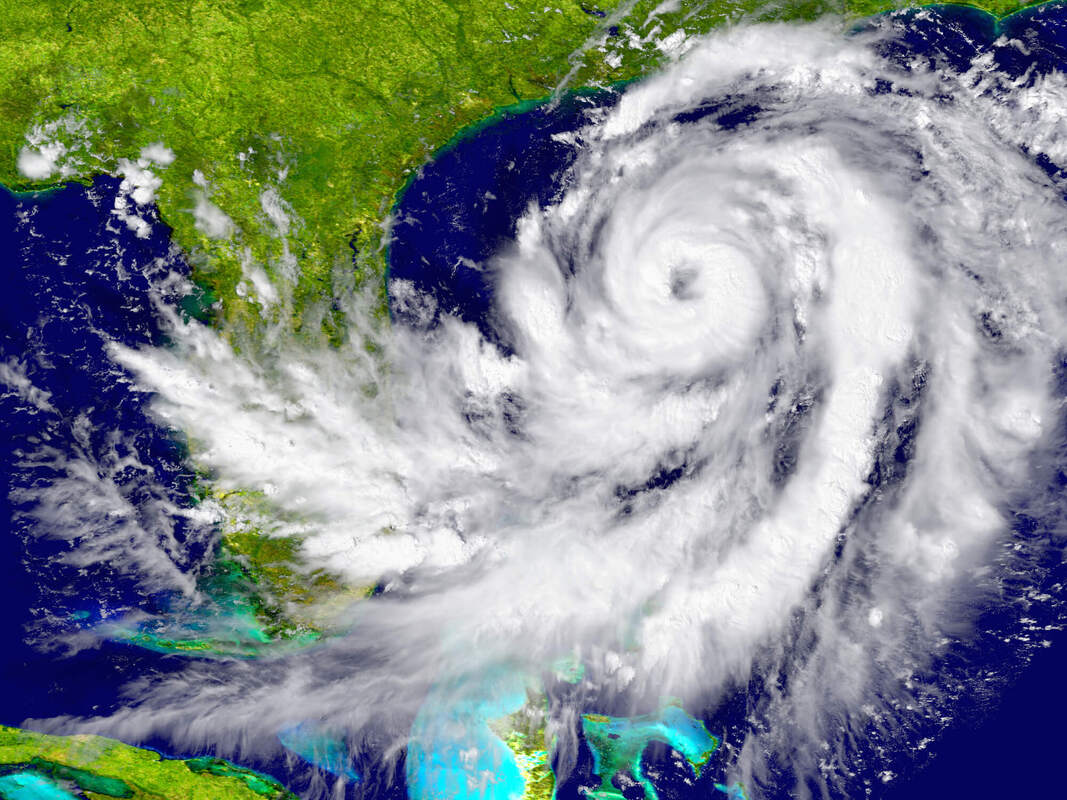

As public adjusters in Broward County, we have had significant experience through the years helping property owners get compensation and full coverage after a hurricane. The process is more confusing than what most expect when they file a property damage insurance claim.

Let’s discuss the policies that provide coverage, as well as explain the best action to take to get compensation from your insurance company. Which Policies Provide Coverage in the Event of Hurricane Damage Insurers do not typically offer a specific hurricane insurance policy. This means that the damage incurred during a storm must be covered under your wind or hurricane coverage within your policy. While insurance policies often vary, yours will likely provide this coverage, but it comes with a price of a higher deductible. Windstorm Insurance While this is sometimes referred to as a wind or hurricane policy, it does not always cover water damage caused by flooding. The key is whether the water damage is caused by the wind. For instance, if wind damage provides an opening in your property that then water enters your property and causes water damage, you will be covered. You are less likely to get compensation if the water damage is unrelated to wind or flooding unless you have a separate flood insurance policy. Flood Insurance Flood insurance is designed to cover the water damage caused by things like storm surges or flooding. The flood needs to cover more than just your property or spread across at least two acres. Can You Get Compensation for Mold or Debris Removal? Homeowners insurance can provide coverage for mold. However, insurers do not provide coverage or compensation if the mold is a result of negligence or lack of maintenance to your property. Homeowners insurance can also provide coverage and compensation for debris removal, but that amount is usually capped within the policy. That said, this coverage can be limited, and you may still need to incur a portion of the debris removal. How You Can Get Compensation With Your Current Coverage Being properly covered before a loss is important. If a hurricane has already come, it is too late to change your policy if you sustain damage. It is a good idea to speak to a public adjuster with the knowledge and experience to review your policy in detail and determine if you have property coverage. If your property damage claim is underpaid or wrongfully denied, a public adjuster can assist you at any time. Our experience and expertise allow us to understand everything you are entitled to in order to get the compensation you deserve. Looking for a Public Adjuster in Broward County? At Reliant Insurance Adjusters, we are committed to helping property owners file proper claims with their insurance company. Whether you are ready to file a claim or you are anticipating a potential loss, we are here to help. We offer Pre-Loss Property Inspections, which prove your property was not damaged prior to a loss. Please do not hesitate to contact us through our site or call us (561) 288-6434 today.

0 Comments

Leave a Reply. |

AuthorKaren Schiffmiller Archives

July 2024

Categories |