|

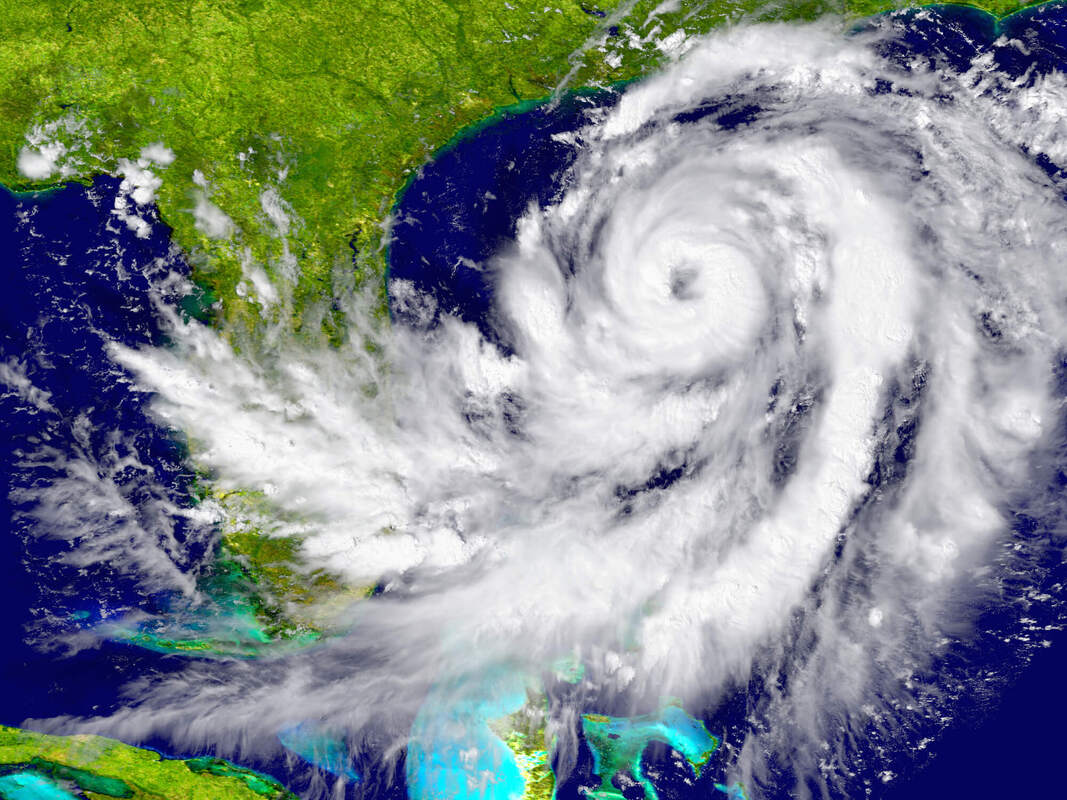

In our work as Fort Lauderdale public adjusters, we have helped property owners file insurance claims for property damage caused by fire, water damage, flooding, hurricanes, and tornados.

As a Florida property owner, there are important things you want to know about the causes of fire. This includes how much risk fires represent in Florida, as well as the insurance policy most likely to provide coverage. Check Your Insurance Coverage As public adjusters, we help property owners receive claim settlements from their insurance company after a loss or disaster has occurred. That said, we are limited in what we can do if your policy does not provide coverage in the event of a fire or loss. This is why it is important to understand your insurance policy and the coverage it provides. Most insurance policies provide coverage for fire damage if the fire was caused accidentally. This includes but is not limited to damage caused by:

If the fire was set intentionally, it is considered arson and is excluded from both residential and commercial insurance policies. To better understand what is covered your insurance policy, it is important to speak with a public adjuster. Does Homeowners Insurance Cover Damage Caused by the Fire Department? While putting out a fire, the fire department can actually cause more damage to your property such as water damage or drywall damage just to name a few. We previously discussed an incident where a client was without power for a week and therefore was not able to mitigate the water the fire department used to put out the fire. As you would expect, mold started to grow, and we had to not only address the fire and smoke damage, but include the water damage and mold. It is important to note that water and mold damage are not the fire department’s responsibility. Their goal and purpose are to ensure that the fire is put out as quickly as possible all while keeping their firefighters safe from harm. Are Florida Properties at Serious Risk for Fire? Florida has the third largest number of properties at risk for wildfire damage, after California and Texas. While this is a startling number, it also speaks to the size of the state. Wyoming and New Mexico have a higher percentage of properties at risk, but they have less properties overall. Because Florida is a humid state, fires do not spread the way they do in California which is typically drier throughout the year. Of course, even with all these factors, residential and commercial property owners still need to be careful. Even if wildfires are less severe in Florida than in other states, it is still very possible for a fire to start in your home or business. We recommend following these fire prevention and safety tips to say safe and help prevent a fire. Looking for a Public Adjuster in Fort Lauderdale? At Reliant Insurance Adjusters, we are committed to helping residential and commercial property owners understand their policy and get the settlement they deserve from their insurance company. If you have any questions about how we can help you or would you like to speak with us regarding your insurance claim, contact us today.

0 Comments

There are more than 50,000 employer establishments in Palm Beach County. While these businesses can represent major sources of revenue for their owners, they are also at risk for all kinds of property damage: weather events, fire, theft, water damage and more.

If you own a business in the area, it is a good idea to speak with a public adjuster in West Palm Beach. We can help you understand what coverage you have and help you file an insurance claim. Many business owners have business personal property insurance, which provides essential coverage. What Is Business Personal Property Insurance Designed to Cover? Business personal property (BPP) coverage is part of a broader commercial property insurance policy. While the broader commercial policy is likely to provide coverage for the building if you own it, BPP specifically is designed to encompass the items that are not a part of the building. This can include:

While BPP does not provide coverage for the building, it will likely provide coverage for improvements you have made to the building. It is designed to protect against several different kinds of property damage like water, fire storms, theft, and vandalism damages. As always, policy coverage varies from policy to policy and we will review your policy to determine and help you understand your coverages. Does Business Personal Property Insurance Cover Office Equipment in My Home? Business personal property coverage can include office equipment if you have a home-based business. If you own a home-based business, it is important to review your homeowners insurance policy because it may not provide the coverage you need. Depending on the size of your home-based business, you may need to supplement your homeowners insurance policy with increased business property limits, an in-home business policy, or business personal property insurance. Business personal property insurance is also tax-deductible, which makes it a great choice for all kinds of businesses. Does BPP Cover Other People’s Personal Property? There may be situations where another person’s property is put under your care, control, or custody. While BPP will not provide coverage, the broader commercial property insurance policy will. What If Your Insurance Company Disagrees Regarding Your BPP Coverage? If your insurance company denies your claim, there are still options to receive a claim settlement. The earlier you choose to work with a public adjuster, the better. We thoroughly document your claim, and assist with making sure all of your post loss policy obligations are met. Additionally, we can provide a pre-loss inspection report before damage even occurs and prove the condition of your property prior to any loss. I cannot stress enough how our clients who sustained flood and wind damage from Hurricane Ian wished they had done this as we sift through all the damage and try to document their damaged business personal property. Are You Looking for a Public Adjuster in West Palm Beach? You have come to the right place. We are experienced public adjusters and are dedicated to helping homeowners and business owners get the settlement you deserve. If you have any questions or would like to speak with us, contact us today. We are always happy to help. As public adjusters in Boca Raton, we work with both commercial and residential policyholders to help them receive the right claim settlements for their property damage. This means filing an insurance claim after damage has occurred, but we also provide a service where we document the condition of your property before damage occurs.

Insurance companies ask commercial property owners for all kinds of information once a claim has been filed. Given the fact that it can be difficult or sometimes impossible to get this information, pre-loss inspections can be vital for getting your claim approved when the insurance company asserts the damage is pre-existing to the loss date or that the damage has been going on over a period of time. What Is a Pre-Loss Inspection? A pre-loss inspection is designed to provide you with a photo report and/or videos showcasing the current condition of your property. The methods we use for taking this documentation will vary depending on your needs. In most cases, we take extensive photos of the interior and exterior of your property together with a drone video of your roof. In other cases, a drone video of just the exterior of the property and roof, or just interior photos of the property is sufficient. Either way, if you ever need to file an insurance claim, the goal is to prove there is no pre-existing damage to your property. In Florida, pre-loss inspections are especially common before hurricanes or other catastrophic events such as fire, lightning strikes or hail damage. That said, pre-loss inspections can be useful any time you are concerned about having the documentation you will need to file a claim with your insurance company. Here are just some of the insurance claims where a pre-loss inspection report can help you:

What is the Difference Between a Commercial and Residential Pre-Loss Inspection? There are some areas of overlap between residential and commercial pre-loss inspections. For instance, both commercial and residential policyholders will want documentation regarding the current condition of your property. However, we also keep in mind the different kinds of claims a building owner and homeowner might have and have different pre-loss inspection packages. Why Business Owners Choose Reliant Insurance Adjusters for Pre-Loss Inspections When hiring a public adjuster for a pre-loss inspection, you want to look for knowledge and experience. An experienced public adjuster in Boca Raton will be able to anticipate problems before they occur or catch something you may not see. This will allow you to protect your property by repairing it timely. We also know what to look for and how to properly document your claim to avoid a claim denial. In some cases, this can mean letting you know about aspects of your property that are not covered in your policy. We discussed this in our recent blog about EIFS exclusion. While inspecting your property, we will also be able to provide examples specific to your property should they exist. Along with that, it is also useful to find someone with skills that can help during the information gathering process. My business partner, Scott Scovin, is a licensed drone pilot. By working with a drone pilot who understands insurance, you can rest easy knowing that all the information needed will be gathered. Are You Looking for a Public Adjuster in Boca Raton? You have come to the right place. At Reliant Insurance Adjusters, we have decades of experience helping commercial and residential property owners understand their policies and file claims with their insurance company. Whether you are currently in the process of filing your claim or you have been underpaid or denied for your claim, we can help. Are you prepared in the event of a hurricane or other catastrophic event such as fire? Either way, please do not hesitate to contact us. We are always happy to help property owners navigate the complicated world of insurance. Mold is one of the more complicated forms of property damage, in part because it is not always easy to determine whether the damage was caused by the mold itself or by the water that caused the mold.

What you should know when trying to get compensation for mold damage. Specifically, we will discuss the two policies that are most likely to provide coverage, as well as what to do if an insurance company denies your claim. Does Homeowners Insurance Cover Mold? There is no such thing as a “mold claim.” Instead of writing policies specifically centered around mold damage, insurance companies sell policies that can compensate for mold damage when the mold results from a peril that is covered under your policy. Mold in and of itself, it not a covered peril. Homeowners insurance will usually cover mold damage if it is caused by a covered peril for which you have coverage. For instance, let us say that your home was damaged when a water heater unexpectedly leaked. If the damage caused by the water heater is covered, and mold occurs as a result of the water damage, you will be covered. It is important to note that homeowners insurance does not provide coverage for lack of maintenance or wear and tear to your property. If the mold grew slowly over a period of time as a result of a leaky faucet, you will not be covered nor will you receive compensation if you file a claim. Does Flood Insurance Cover Mold? Much like homeowners insurance, there are some situations where a flood insurance policy will cover mold. The key is that you do everything in your power to prevent the mold from occurring. Under a flood insurance policy, it is sometimes difficult to get compensation for mold if you have access to your property but did not dry it timely. However, if your property was not accessible as a result of the flood, or there was no power and you were not able to remove the moisture and mold starts growing, it is possible you can get compensation for mold damage. It is important to understand that every insurance policy is different so it is ideal to speak with an insurance expert who can review your policies and explain your coverage. What If Your Insurance Company Denies Your Claim? Denied claims can be upsetting if you expect your insurance company to pay for damage to your property. A claim denial does not necessarily mean that the process is over. Instead, it is a good idea to find an experienced and knowledgeable public adjuster to review your policy and explain your coverage. If it is determined that your policy covers the damage, a knowledgeable public adjuster can reopen your claim. There are many methods we use to document and prove the damage is covered to help you get compensation for your claim. We have been successful in overturning many claim denials for our clients. Looking for Public Adjusters in Palm Beach County? You have come to the right place. At Reliant Insurance Adjusters, we work with property owners who want to understand their policy better and get the compensation they deserve. Our backgrounds, coupled with many years of experience, give us an advantage when dealing with insurance companies. We provide free policy reviews whether you have a claim or not. If you have been underpaid or denied for your insurance claim, please do not hesitate to contact us today. As public adjusters in Broward County, we have had significant experience through the years helping property owners get compensation and full coverage after a hurricane. The process is more confusing than what most expect when they file a property damage insurance claim.

Let’s discuss the policies that provide coverage, as well as explain the best action to take to get compensation from your insurance company. Which Policies Provide Coverage in the Event of Hurricane Damage Insurers do not typically offer a specific hurricane insurance policy. This means that the damage incurred during a storm must be covered under your wind or hurricane coverage within your policy. While insurance policies often vary, yours will likely provide this coverage, but it comes with a price of a higher deductible. Windstorm Insurance While this is sometimes referred to as a wind or hurricane policy, it does not always cover water damage caused by flooding. The key is whether the water damage is caused by the wind. For instance, if wind damage provides an opening in your property that then water enters your property and causes water damage, you will be covered. You are less likely to get compensation if the water damage is unrelated to wind or flooding unless you have a separate flood insurance policy. Flood Insurance Flood insurance is designed to cover the water damage caused by things like storm surges or flooding. The flood needs to cover more than just your property or spread across at least two acres. Can You Get Compensation for Mold or Debris Removal? Homeowners insurance can provide coverage for mold. However, insurers do not provide coverage or compensation if the mold is a result of negligence or lack of maintenance to your property. Homeowners insurance can also provide coverage and compensation for debris removal, but that amount is usually capped within the policy. That said, this coverage can be limited, and you may still need to incur a portion of the debris removal. How You Can Get Compensation With Your Current Coverage Being properly covered before a loss is important. If a hurricane has already come, it is too late to change your policy if you sustain damage. It is a good idea to speak to a public adjuster with the knowledge and experience to review your policy in detail and determine if you have property coverage. If your property damage claim is underpaid or wrongfully denied, a public adjuster can assist you at any time. Our experience and expertise allow us to understand everything you are entitled to in order to get the compensation you deserve. Looking for a Public Adjuster in Broward County? At Reliant Insurance Adjusters, we are committed to helping property owners file proper claims with their insurance company. Whether you are ready to file a claim or you are anticipating a potential loss, we are here to help. We offer Pre-Loss Property Inspections, which prove your property was not damaged prior to a loss. Please do not hesitate to contact us through our site or call us (561) 288-6434 today. The existence of apps like Airbnb has led many people to start renting their homes out on a short-term basis. While this can represent a new income stream for homeowners, it can also lead to insurance complications if you do not have the correct insurance policy on your property.

Does homeowners insurance provide coverage if you are renting your home for a short period of time? If not, what are your best options for getting the compensation you need if a guest causes damage to your property? Learn what you need to know from expert Palm Beach County public adjusters. What Kinds of Damage Do You Need Coverage For? There are two major things you need to be prepared for when renting out your home:

Does Your Homeowners Insurance Policy Cover Damage Caused During Short-Term Rentals? A standard homeowner insurance policy will not cover damage caused if you are regularly renting your property. For this, you would need a dwelling policy. It is important to review your policy, because you may be required to inform the insurance company before renting or even add an endorsement to obtain coverage. If you sustain damage to your property and believe your policy covers the damage caused during a rental period, you should consult with a public adjuster. They will have the knowledge and expertise necessary to review your policy and assist you with filing an insurance claim. Getting Covered for Damage Caused During a Short-Term Rental If damage occurs to your property while you are renting it, there are several options available to you. First, you need to determine if the damage is covered by your policy (e.g., a natural disaster, fire damage or water damage that occurs while you were renting your property). If your insurance policy does not cover the damage, you might still be able to receive compensation elsewhere. For instance, Airbnb offers host damage protection for up to $1 million. It is important to note that AirCover for Hosts will not provide coverage for damage that is covered under a typical homeowners insurance policy like hurricane damage. In order to receive coverage by Airbnb, you are required to provide evidence of the damage. If you plan on renting your home, it is important to perform an inspection ahead of time. This way, you will document the condition of your property prior to anyone staying in your home and proof that any damage that occurs happened during the rental. Looking for Palm Beach County Public Adjusters You have come to the right place. At Reliant Insurance Adjusters, we work with residential and commercial property owners to help ensure you receive everything you are entitled to for your insurance claim. We have decades of experience in the insurance industry, and our reputation speaks volumes. Now, more than ever, insurance policies cover less and less. We are always happy to help you gain a better understanding of what your policy does and does not cover. Please do not hesitate to contact us or call (561) 288-6434. There are more lightning strikes in Florida than anywhere else in the US. This puts our state at high risk for fires. If a fire has damaged your Florida property, you are going to need to file an insurance claim.

As South Florida public adjusters, it is our role to help you file your claim accurately, and get you covered and paid for everything you are entitled to receive under your policy. Below I will explain the likelihood that your policy covers fire damage, as well as explaining some of the steps you can take to prevent fire damage in the future. Does Homeowner’s Insurance Cover Fire Damage? It is always important to check your policy to see exactly what it covers. That said, a homeowners insurance policy typically covers fire damage. This includes fires started accidentally in your home, as well as fires caused by lightning and also wildlife fires. There are some exceptions to coverage, the biggest being if you started a fire in your home with the intent of causing damage to it. Acts of war are also not covered by insurance. The amount of coverage you can receive may be dictated by your dwelling limit and your personal property limit. How to Protect Your Home from Fire Damage The only thing better than receiving the proper claim payment for damage is not needing that payment in the first place. There are several steps you can take to mitigate the likelihood of fire damage:

Filing a Fire Insurance Claim with Your Insurance Company If your property has been damaged by a fire, you will need to file a claim with your insurance company. In this situation, a public adjuster can help you document all the damage and assist with the submission of the necessary information. On average, people who hire public adjusters get 500% more of a settlement on their claim. If your claim is underpaid, a public adjuster can assist and reopen your claim. If the insurance company remains unconvinced by the evidence and documentation submitted, most insurance policies allow for a dispute resolution such as appraisal. If needed during the appraisal process, an insurance umpire can help settle the dispute and find a fair resolution for both parties. Looking for a Public Adjuster in South Florida? You have come to the right place. At Reliant Insurance, we are committed to helping our clients understand their coverage and get you everything you are entitled to under your policy. We have decades of experience representing residential and commercial insurance claims. We also provide free insurance policy reviews. Please do not hesitate to contact us today. We are always happy to help. As a public adjuster in Fort Lauderdale, we are here to help you get all the information you need to file a claim with your insurance company. Pre-loss inspections are one of the tools we use to help you get the proper results for your insurance claim.

If you are a condo owner, it is useful to understand when you should get a pre-loss inspection, and what exactly we look for during this service. How Pre-Loss Inspections Benefit Condo Owners Prepare for Hurricane Season As a property owner in Florida, you are likely aware of the trouble that hurricane season can cause. Having your unit inspected beforehand narrows the window of time during which damage to your property could have occurred. This is important because policies are specific about what they cover. If the insurance company believes your unit sustained damage due to a maintenance issue, your claim is less likely to be covered. A pre-loss inspection adds clarity and proof to your claim, which allows you to show that the damage was not present prior to the loss or damage occurring. Give You a Better Understanding of Your Insurance Coverage Even putting hurricane season aside, a pre-loss inspection can be very helpful. It gives you a deeper understanding of the condition of your property. More important, if there is an existing problem that is hidden and unknown to you, our pre-loss inspections give you the opportunity to repair it and protect your property from further damage. What to Expect from a Pre-Loss Inspection of a Condo Unit If you have a standard HO-6 policy, pre-loss inspection will document the condition of the interior of your property. The association owns the building and their insurance policy will provide coverage for the exterior of the property, therefore, the exterior would not be included in this type of report. Before we begin our inspection, we will explain what is and is not covered in your HO-6 policy. There are certain elements covered in the policy such as your wall coverings, cabinetry, tile, flooring etc. as well as appliances and personal belongings. We will then prepare a report. This documentation can include both photos and videos. Having this information will help you in the event you need to file a property damage insurance claim with your insurance company. If you do not want to file the claim yourself, or you need help with your insurance company, we are here for you. Looking for a Public Adjuster in Fort Lauderdale? At Reliant Insurance Adjusters, we are committed to making the insurance claims process as effective and simple for you as possible. We understand that it can be frustrating and difficult to document your damages and negotiate with your insurance company while you are going through repairs to your property. We have decades of experience handling insurance claims and providing public adjusting services to our clients. We specialize in residential and commercial insurance claims whether it is a new claim, underpaid or denied claim. We also provide free policy reviews. Contact us here if you have any questions. If you are filing a claim, you want to make sure that you get the compensation you deserve. This can be complicated, both because of the details of the policy and the nature of determining how the damage occurred.

At Reliant Insurance Adjusters, we provide the services necessary so you receive full settlement of your claim. Along with offering public adjuster services in Broward County, we also offer appraisal and umpire services. Let me explain when you might need an umpire, as well as the qualities you should look for from that umpire. When Umpires Are Necessary When you and your insurance company are not be able to come to an agreement on the amount of your claim, some policies are written with an appraisal and umpire clause, also known as an alternative dispute resolution. An umpire is called in when both the appraiser for you and the insurance company are unable to reach an agreement. Similar to an arbitration agreement, an umpire clause allows for a third-party to come in and resolve the dispute. The exact process will vary depending on your policy, which is why it is important to speak with an insurance professional. That said, the umpire will typically become part of an appraisal panel, consisting of the umpire, as well as representatives for both the insured and the insurance company. Only two of the three members need to agree to resolve the claim. How Do You Find the Right Insurance Claims Umpire? The umpire has a major impact on how much the property owner receives for their claim settlement, which means it is essential to work with an umpire that both parties agree to and trust and who will be fair and unbiased. There are several qualities to look for from any umpire that you are considering:

In most cases, the appraiser for the insurance company and your appraiser, will both have lists of acceptable umpire candidates. They normally share their lists and agree to a mutual and acceptable umpire in the event they are not able to reach an agreement. Looking for an Umpire or Public Adjuster in Broward County? You have come to the right place. At Reliant Insurance Adjusters, we are committed to helping our clients receive the proper claim settlement. The claims process can be very complicated and daunting, and we are here to relieve you of the burden. Whether you have a new, underpaid or denied claim, or you just have a question, we are here to assist. Please do not hesitate to contact us. We are always happy to help you understand your insurance coverage. If you need a public adjuster in Boca Raton, you have come to the right place. At Reliant Insurance Adjusters, we offer a variety of services designed to help you should you have an insurance claim. One of these is roof inspections recorded with a drone.

Learn why drone videos are valuable, what you should look for when hiring a drone pilot, and the situations where we may recommend a different kind of inspection. Why Are Drone Videos Valuable? You want to have as much information as possible when filing your claim. The more ambiguity, the easier it is for an insurance company to potentially deny a claim. Drone videos can provide essential information in support of your claim. A pre-loss property inspection can also help narrow down when the damage occurred. It also provides clear evidence of your property prior to a loss. This is important because insurance policies are not typically designed to cover maintenance related issues or long-term damage. Interior property inspections and drone footage can help you show the condition of your roof and the exterior and interior of your property before it is damaged. This type of report will assist in getting coverage for your claim. What Should You Look for When Hiring a Drone Video Roof Inspection Expert? The next step is to find someone to assist you and two qualities you should look for:

Are There Any Situations Where We Cannot Use Drones? Yes, there are certain situations where we cannot use drones. Airports and military bases have restrictions against civilian drones. If you own property close to either, call us and we will help you determine whether drones can be flown over your property. If there is any reason why we may not be able to use a drone, we will discuss your best options for getting your property inspected. Our goal is to make sure you have all the documentation you need for your insurance claim. Looking for a Public Adjuster in Boca Raton? You have come to the right place. At Reliant Insurance Adjusters, we are committed to helping property owners receive the compensation they need in the aftermath of an unexpected event. We have been interpreting policies and handling insurance claims for years, which means you can rest easy knowing we are on your side. Do you have any questions about what we can do for you? Would you like to speak with an expert who can help you file your insurance claim? Please do not hesitate to contact us. |

AuthorKaren Schiffmiller Archives

July 2024

Categories |